Carter Cofield – Tax Free Living Course

$1,497.00 Original price was: $1,497.00.$149.00Current price is: $149.00.

Carter Cofield Tax Free Living Course – Your Blueprint to Tax Free Living Course [Instant Download]

1️⃣. What is Tax Free Living Course:

Tax Free Living Course by Carter Cofield teaches how to minimize tax liability legally.

It shows entrepreneurs and creatives how to turn personal expenses into business deductions.

The course covers strategies to save $20,000 – $100,000 yearly on taxes.

It explains tax-free investing in stocks and real estate, and effective record-keeping to prevent audits.

📚 PROOF OF COURSE

2️⃣. What you will learn in Tax Free Living Course:

The course teaches how to legally reduce taxes and increase savings.

What you will learn:

- Convert personal expenses to business deductions

- Use strategies to save over $100,000 in taxes

- Pay children tax-free to build family wealth

- Make lifestyle expenses tax-deductible

- Invest tax-free in stocks, real estate, and cryptocurrency

- Organize finances to avoid audits

Course curriculum covers transforming expenses, tax-saving strategies, family wealth building, lifestyle deductions, tax-free investing, and financial organization.

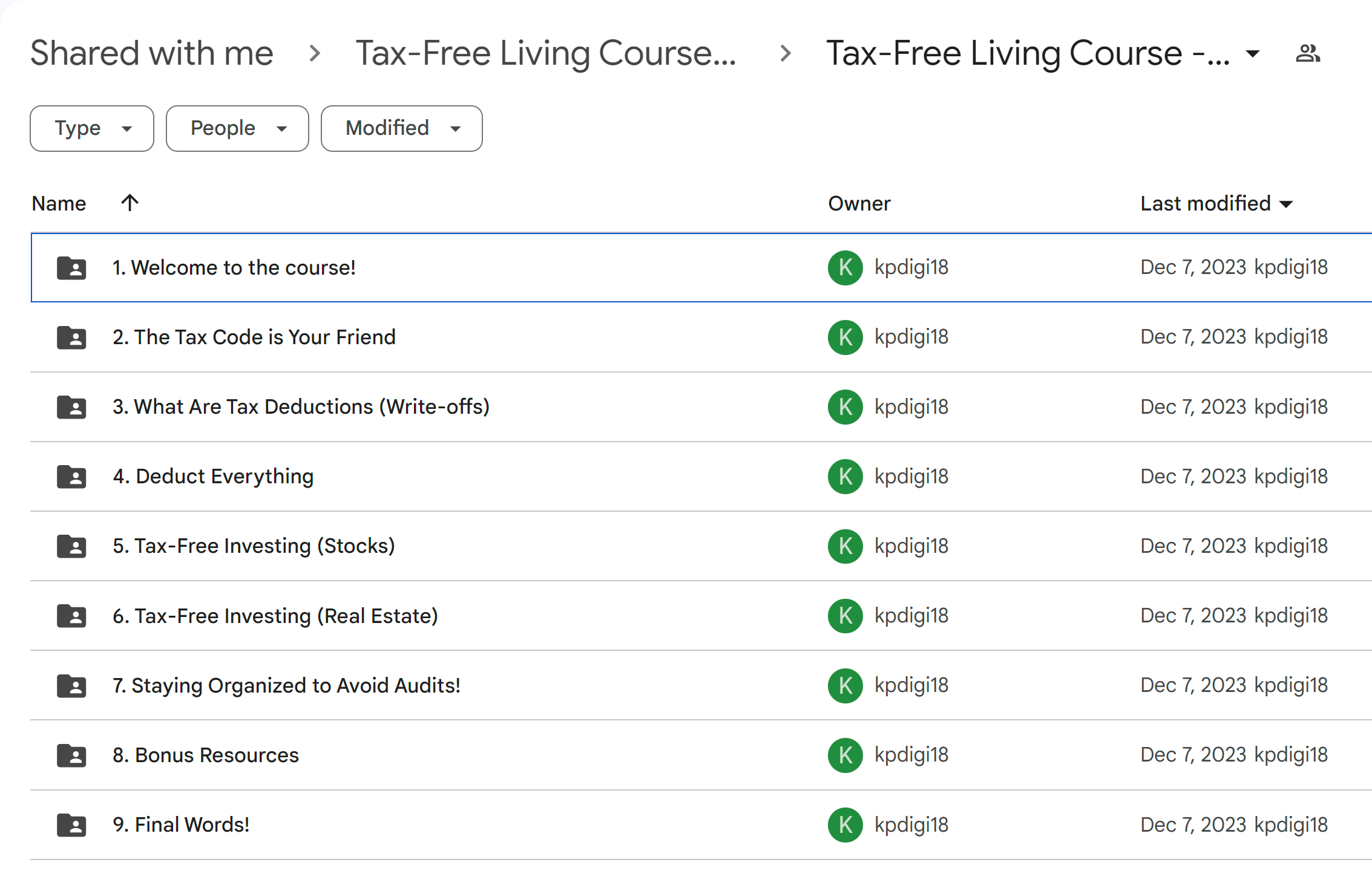

3️⃣. Tax Free Living Course Curriculum:

Tax Free Living Course Curriculum:

1 Welcome to the course!

- A message from the instructor

- How to use this course

- Before we begin…

- Quick Disclaimer (please read)

- Deduct Everything Powerpoint Slides

2 The Tax Code is Your Friend

- How to Make the Tax Code Your Friend

- Employees Vs. Entrepreneurs – The Golden Formula

- The Golden Formula Example

- Bonus: Side Gig Cheat Code!

- Side Hustle BootCamp (Optional)

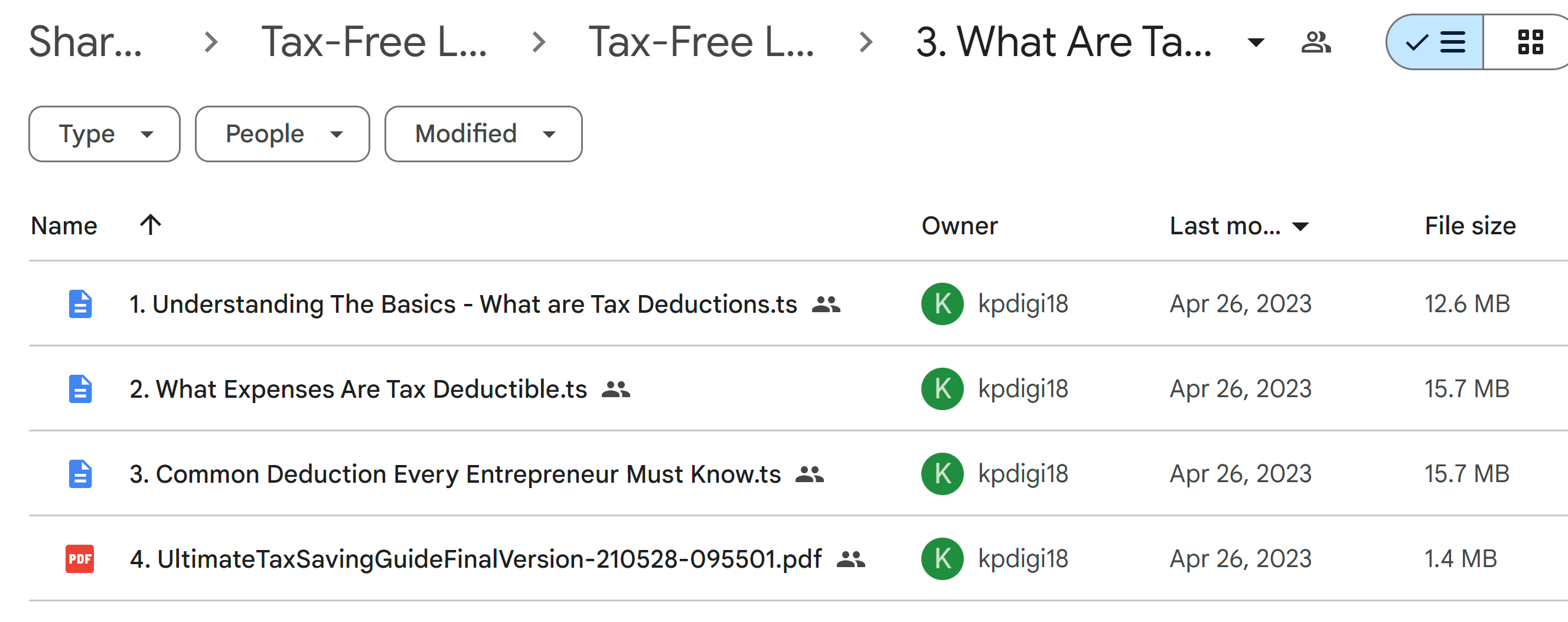

3 What Are Tax Deductions (Write-offs)

- Understanding The Basics – What are Tax Deductions

- What Expenses Are Tax Deductible?

- Common Deduction Every Entrepreneur Must Know

4 Deduct Everything – Making Your Lifestyle Tax Deductible

- Turning Personal Expenses Into Business Deductions

- 10 Personal Expenses that Are Business Deductible

- Ultimate Tax Deduction Calculator Walkthrough

- Tax-Free Traveling & Shopping!

- Side Gig Cheat Code Pt.2

- How to Write-off a G-Wagon & Tesla!

- Paying Your Children Tax-Free!

- How to Write-Off Cartier Frames!

- Tax-Free Living E-Book! 200+ Tax Deductions!!

- Finding Business Use For Every Toy You Own!

5 Tax-Free Investing (Stocks)

- Long Terms Vs. Short Term Capital Gains

- Tax Loss Harvesting

- Tax Advantaged Investment Accounts

- Self-Employed Retirement Accounts

- Investing in Cryptocurrency Tax-Free (Self Directed IRA)

- Taxes For Traders

- Taxes for Traders Cheat Sheet!

6 Tax-Free Investing (Real Estate)

- Earn in Pocket – Lose on Paper

- 1031 Like-Kind Exchange

7 Staying Organized to Avoid Audits!

- Getting Organized & Record Keeping

- Bookkeeping Masterclass (Full Quickbooks Walkthrough)

- IRS Red Flags – 10 Tips to Avoid Audits

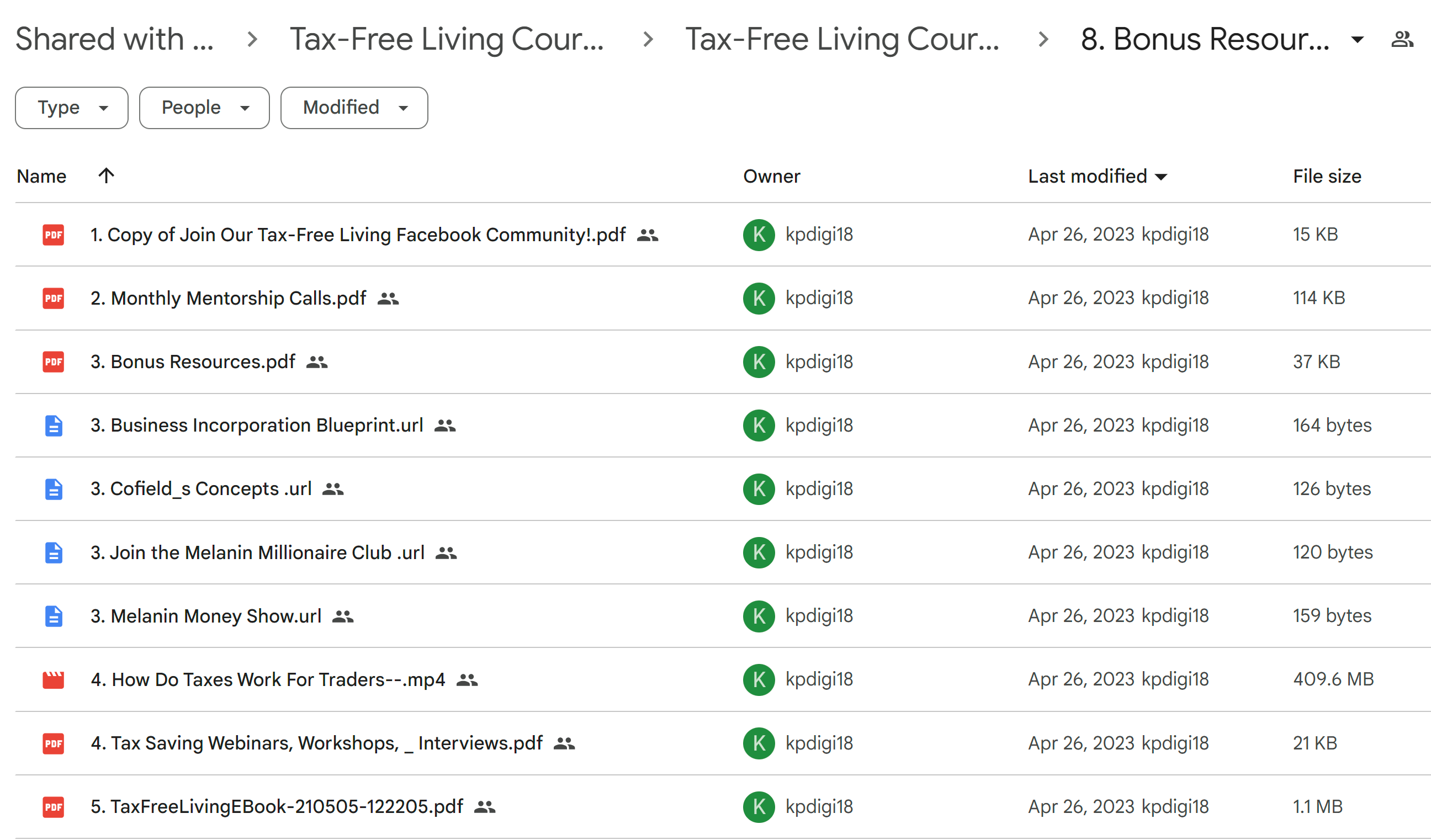

8 Bonus Resources

- Copy of Join Our Tax-Free Living Facebook Community!

- Monthly Mentorship Calls

- Bonus Resources

- Tax Saving Webinars, Workshops, & Interviews

- TAX-FREE LIVING E-BOOK! 200+ DEDUCTIONS

9 Final Words!

- Final Words

- Help Us Help You!

By the end, you’ll have a toolkit of strategies for tax-free living to improve your financial future.

4️⃣. Who is Carter Cofield?

Carter Cofield is a CPA and financial expert for creative professionals. He owns Cofield Advisors, LLC, focusing on tax optimization and financial planning for entrepreneurs.

Carter combines financial expertise with knowledge of the creative industry. His Tax-Free Living program teaches creatives how to reduce taxes and increase wealth.

He’s known for explaining complex financial ideas simply. Carter believes everyone can benefit from the tax code with proper understanding.

Through his courses and advice, Carter has helped many clients save on taxes and improve their finances.

5️⃣. Who should take Carter Cofield Course?

The Tax-Free Living Course is ideal for:

- Creative entrepreneurs and freelancers wanting to maximize deductions

- Small business owners looking to reduce taxes legally

- Side hustle enthusiasts aiming to optimize tax on extra income

- Investors seeking tax-efficient strategies for stocks, real estate, and crypto

- High-income professionals needing advanced tax-saving techniques

Whether you’re new to business or an experienced owner, this course offers practical strategies for tax-free living.

6️⃣. Frequently Asked Questions:

Q1: Can I deduct home office expenses?

Yes, if you use part of your home exclusively for business. Calculate the percentage of your home used for work and deduct that portion of rent, utilities, and maintenance.

Q2: Are vehicle expenses tax deductible?

You can deduct vehicle expenses for business use. Choose between actual expenses or the standard mileage rate. Keep detailed logs of business trips.

Q3: Can I deduct meals and entertainment?

Business meals are 50% deductible. Entertainment expenses are generally not deductible. Keep receipts and note the business purpose of each meal.

Q4: What educational expenses are tax deductible?

Work-related education to maintain or improve job skills is deductible. This includes courses, books, and supplies. Certain restrictions apply for degree programs.

Q5: How long should I keep tax records?

Keep records for at least 3 years from the date you filed your return. For some items like property, keep records for 7 years after disposing of the asset.

Reviews

There are no reviews yet